Not all business is good business

At Cyril Ramaphosa’s Investor Conference late last year, multinational corporations pledged billions of rands to the future of South Africa. The hype was intoxicating, crowned by Jack Ma’s enthusiastic call for investment in education and entrepreneurship: ‘For a country to develop, there are three basic things that have to be done that are important. The first is education; it’s always good to invest in education. Investing in people is the best investment in the whole world. And the second thing is trust; build and support entrepreneurs. Make entrepreneurs the heroes. At the top of this is a good and clean government.’ Ramaphosa echoed his sentiments: ‘We want to make our businesspeople heroes. Let us see them as heroes because they are here to develop our economy.’

This is a dramatic change from the rhetoric of our previous president, when entrepreneurs were publicly castigated as pariahs pushing against transformation, inclusion and equality. Ramaphosa acknowledged this: ‘We should … move away from what we’ve become accustomed to where we treat entrepreneurs and call them all sorts of names. We treat them as enemies, with terms like white monopoly and all that. It ends today.’ At the conference, companies like Naspers promised R6 billion to invest in the technology sector and start-ups. It suggests a moment of optimism after years of lacklustre economic performance.

But not all business is good business.

While investments like Naspers’ is indeed a sensible shift towards nurturing the next generation of entrepreneurs, we should not necessarily assume that big investments result in better outcomes. When entering a new country, a multinational firm can easily drown out local competitors. And while they often may provide better (or more appealing) products and services to consumers, because of their scale, they may also influence political and policy processes that are ultimately to the detriment of the country.

Take Heineken. One of the largest beer brewers in the world, Heineken is one of the best-known brands on the African continent. It operates 56 plants in 23 African countries. While Africa, according to the latest available figures, constitutes 14.7% of its global sales volume, it makes up 20.8% of its global profits; in other words, every beer sold in Africa is 42% more profitable than a beer sold elsewhere.

Take Heineken. One of the largest beer brewers in the world, Heineken is one of the best-known brands on the African continent. It operates 56 plants in 23 African countries. While Africa, according to the latest available figures, constitutes 14.7% of its global sales volume, it makes up 20.8% of its global profits; in other words, every beer sold in Africa is 42% more profitable than a beer sold elsewhere.

Olivier van Beemen, a Dutch investigative journalist and PhD student at the University of Amsterdam, has written a provocative book on why Heineken is so successful in Africa. Available only in Dutch and French but with an English translation scheduled for February 2019, the book highlights the often shocking practices Heineken engages in or, at the minimum, allows to happen under its watch. I will not go into specifics, but Van Beemen mentions all the usual suspects, and more: fraud, corruption, tax avoidance, sexual abuse, even collaboration with dictators.

How could a multinational with an excellent reputation in Europe engage in such unlawful and amoral practices? The answer, in short, is the ability to exploit weak institutions. It an environment where the rule of law is suspect, where property rights are lax, or where an independent media is weak or ineffective – true for many African countries in the past and in the present – multinationals can often influence the very institutions that are supposed to regulate their behaviour.

Van Beemen published his first book on Africa in 2015. Heineken initially chose not to respond, but for his second, they were more willing to engage. They naturally deny many of the claims, but also mention that a lot of what Van Beemen mentions had happened ‘a long time ago’. Depressingly, they also mention that it is tough to be ‘an island of perfection in a sea of misery’. Reading between the lines: Africa is to blame, and we do a great job in the circumstances.

There has been some reaction from within the Netherlands to these revelations. Questions were asked in the Dutch and European parliaments, and a motion was voted in to encourage multinationals to improve their behaviour abroad. A bank decided to divest from Heineken.

But, according to Van Beemen, little has changed on the ground. Africa remains hugely profitable for Heineken. (Incidentally, since Van Beemen’s first book, Heineken does not report its profits for Africa separately. Strangely, African profits are now combined with the very unprofitable Russian market, with the consequence that the combined profits are largely the same as the rest of the world.) And it is likely to expand its activity.

If we were just following aggregate foreign direct investment, we would consider more of their investment a good thing. But such investments may have exactly the opposite outcome of nurturing young entrepreneurs. Given Heineken’s market dominance, it would be almost impossible for local entrepreneurs to find a foothold. And given their ability to influence local politicians, as Van Beemen’s evidence points to, it would be hard for any competition to get access to brewing licences or export subsidies.

Van Beemen’s account of Heineken in Africa is very far from Jack Ma’s dream of education, local entrepreneurship and a good and clean government. In the absence of those three things, we may indeed find that further investment are likely to result in worse rather than better outcomes.

An edited version of this article originally appeared in the 22 November edition of finweek.

Five young economists to listen to, and how their ideas might shape our future

Ideas, and the people that give birth to them, shape our future. The British economist John Maynard Keynes articulated it best: ‘The ideas of economists and political philosophers, both when they are right and when they are wrong are more powerful than is commonly understood. Indeed, the world is ruled by little else. Practical men, who believe themselves to be quite exempt from any intellectual influences, are usually slaves of some defunct economist.’ So, on this final day of 2018, let us look at five young economists, and their ideas at the frontiers of the field, that will shape our lives, consciously or otherwise, in 2019 and beyond.

One of the most vexing questions social scientists grapple with is how to build a society where everyone has an equal opportunity of reaching the top. Inequality is not in itself unfair: we all know that rare skills, like those possessed by Messi or Musk, should be rewarded more than the rest of us. But what we deem to be unfair is when someone with those skills or abilities cannot, for whatever reason, realise their potential.

In the US, as in South Africa, there are too many children without equal opportunities for success. How to give these children better chances of succeeding is, in short, the research programme of Raj Chetty, professor of Economics at Harvard University and Director of Opportunity Insights, a think tank that aims ‘to develop scalable policy solutions that will empower families throughout the United States to rise out of poverty and achieve better life outcomes’. Somewhat of a child prodigy, receiving his PhD from Harvard in 2003 at the age of only 23, his most recent project, together with several other colleagues, uses ‘big data’ to map the neighbourhoods in America that offer children the best chances of climbing the income ladder. Their freely available interactive mapping tool show how outcomes like poverty and incarceration can be traced back to the neighbourhoods in which children grew up. More importantly, it also helps to develop customised solutions that will improve the outcomes of children in those ‘bad’ neighbourhoods.

One of Chetty’s younger colleagues is Melissa Dell. Graduating with a PhD from MIT in 2012, Dell spent time at Harvard and Stanford before joining Harvard in 2018 as a tenured professor. Dell is fascinated by the factors that underpin long-run development. For her PhD, she investigated the Mita – a system of forced labour several hundred years ago – to assess its persistent effects on levels of Peruvian income today. She has since worked on the persistent differences between north and south Vietnam, the long-run effects of the Mexican revolution and the consequences of the Dutch cultivation system in colonial Java.

What makes Dell’s career even more impressive is that she has a severe visual impairment. And yet, this has not prevented her from, aside from asking fascinating research questions, starting a foundation in Peru or running ultra-long-distance races, including the Comrades!

Dell is one of three women on my list, a comforting sign in a field that is still mostly the domain of men. Claudia Olivetti, Professor of Economics at Boston College (with a PhD in 2001 from the University of Pennsylvania), is one of several scholars who wants to understand which factors prevent women from entering the labour market, and why they move up at the corporate ladder a slower pace. Olivetti’s latest research shows that the best thing the government can do is to spend more on early childhood care and education as this has the largest improvement in women’s employment rates, salaries and even fertility, decreasing the gender pay gap. The benefits of more parental leave and flexible schedules, she finds, are smaller. Why is this? Because access to good early childhood caretakers that makes it easier for young mothers to work allows women to return to the labour market quicker after childbirth, boosting their life-time earnings. In short: the policies that matter most to women are those that help mothers work – not those that help them take breaks from work.

This type of research aims to identify which policies are best in improving the outcomes we hope for. Another area where such policies are desperately needed, in South Africa and elsewhere, is the health sector. Marcella Alsan, who is an Associate Professor of Medicine at the Stanford School of Medicine with a PhD in Economics from Harvard in 2012, plans to do exactly that: use research to identify which health policies improves health outcomes most. One key concern in health, for example, is how to get clients to use their prescribed medicine. Alsan, in a new study, provides one tantalizing clue: pair the patients with doctors that share a similar ethnic background. She and her co-author runs an experiment where several hundred black patients are randomly allocated white and black physicians. They find that those patients that consulted a black physician are more likely to ask for preventative services, particularly if those services are invasive. They argue that this is because of better communication and trust. The implications are profound: they argue that more black doctors could reduce cardiovascular mortality by 16 deaths per 100 000 per year, leading to a 19% reduction in the black-white male gap in cardiovascular mortality.

It is not only human health that is the subject of economic research. The health of the planet is under threat, with climate change affecting our sustainable future. Solomon Hsiang, Professor of Public Policy at UC Berkeley and Principal Investigator of the Global Policy Laboratory (with a PhD in Sustainable Development from Columbia University in 2011) is one of the leading thinkers on the topic. In a recent Science letter, he weighed in on the ivory-ban discussion. But it is the interactions between the economy and the ecology that is at the heart of his research. In a 2018 Journal of Economic Perspectives overview paper, Hsiang urges his fellow economists to take the lead on climate change research: All climate change forecasts, he says, rely heavily and directly on economic forecasts for the world. ‘On timescales of a half-century or longer, the largest source of uncertainty in climate science is not physics, but economics.’ The lesson? It is not only us, but our children and grandchildren too, that are the slaves of some defunct economist!

*An edited version of this article originally appeared in the 6 December edition of finweek.

Books for the (South African) summer (2018 edition)

It’s that time of year again: sun, sand, sea… and softcovers! Here are the top seven books I read this year, and a list of what I hope to read this summer.

Washington Black, by Esi Edugyan

Washington Black, by Esi Edugyan

A beautiful and brilliant book about Wash, an early nineteenth-century Caribbean boy who escapes the brutal life of a slave (by building an air balloon), and then journeys the world from the Arctic to London to Morocco on a (surprising) scientific quest.

Silence of the Grave, by Arnaldur Indriðason

Whenever I visit a new country, I try to read at least one local crime novel. On a 12 day visit to Iceland in August, I read through four of Indriðason’s superb crime novels. Silence of the Grave is his most celebrated, and my favourite.

The Book Smugglers of Timbuktu, by Charlie English

The past and the present of West Africa are interwoven in the stories of twenty-first century book smugglers and eighteenth-century European discoverers.

Fishing: How the Sea Fed Civilization, by Brian Fagan

It was not only the domestication of grains that allowed us to conquer the globe. Fishing fed human settlement, rising social complexity, the development of cities, and ultimately the modern world. To be enjoyed with fish and chips…

Marriage, a History: How Love Conquered Marriage, by Stephanie Coontz

Marriage, a History: How Love Conquered Marriage, by Stephanie Coontz

Already published in 2006, this accessible history of marriage is both remarkable in its breadth and invaluable as a conversation starter. You may have married for love, but it is highly likely that your grandparents (and certainly their grandparents) did not.

Radical Markets: Uprooting Capitalism and Democracy for a Just Society, by Eric Posner and Glen Weyl

An engaging and provocative view on how markets can reshape society. Particularly relevant for South Africa.

The Great Leveler: Violence and the History of Inequality from the Stone Age to the Twenty-First Century, by Walter Scheidel

Inequality is deepening, and people everywhere are demanding policies that purport to reduce it. Don’t be overly optimistic about these attempts, says Scheidel. A sober view on a topic that will be with us for a long time to come.

On my (non-fiction) reading list this summer:

Sol Plaatje, by Brian Willan

Sol Plaatje, by Brian Willan

Europe in Flames: The Crisis of the Thirty Years War, by John Matusiak

Go Tell the Crocodiles: Chasing Prosperity in Mozambique, by Rowan Moore Gerety

Capitalism in America: A History, by Alan Greenspan, Adrian Wooldridge

Nabokov’s Favourite Word Is Mauve: The literary quirks and oddities of our most-loved authors, by Ben Blatt

Identity: Contemporary Identity Politics and the Struggle for Recognition, by Francis Fukuyama

Unai Emery: El Maestro: The Authorised Biography, by Romain Molina

Ramaphosa’s number one challenge: getting rid of patronage politics

President Ramaphosa is on an investment offensive. Because the South African economy is stalling, he is desperate to attract investors who will create jobs and boost incomes. One way to do that, he believes, is by hosting summits; a Jobs Summit in early October and an Investment Summit a few weeks later would just be the thing to invigorate investor appetite for South Africa.

It was a hard sell. Not only is global economic growth on the wane, but South African internal policies and politics are not creating the stable, low-risk environment that investors crave when the returns are unlikely to be double digits. Whatever the merits of land redistribution, calls for what seems to be an unnecessary constitutional change to allow expropriation create uncertainty. An inability to reduce crime, the one issue that affects all South Africans, makes our country less attractive as an investment destination; The Economist’s recent article on Cape Town’s high murder rate, for example, will undoubtedly hurt tourism. And though Tito Mboweni’s appointment seems to have satisfied markets, it is never a good sign to have a revolving door for the second most important office in government.

All of these ills are rooted in our public sector incompetence – the result of a bureaucracy built on patronage rather than the efficient provision of public services – that makes doing business an expensive and frustrating exercise.

This is the one thing Ramaphosa’s government must begin to address if we are to create the right conditions for growth. As Guo Xu of the Haas School of Business at the University of California, Berkeley notes in an upcoming American Economic Review paper: ‘State capacity is fundamental to development and growth. Bureaucrats are a key element of state capacity: they embody the human capital of the state and are responsible for the delivery of public services and the implementation of policies. Understanding how to promote and incentivize bureaucrats is central to improving organizational performance.’

For much of human history, bureaucrats were appointed through patronage. The way you moved up in society was mostly the result of who you knew rather than what you knew. Even in the United States today, more than 8000 federal positions are still allocated ‘at the pleasure of the president’ (if, of course, he is competent enough to do so). It is also not only in government that you find patronage; we often see family ties and personal connections play an important role in new board appointments.

Theoretically at least, patronage can be a good thing. Loyalty to the superior may incentivise subordinates to not shirk on their work. But patronage can also be bad for organisational performance, as favouritism may disincentivise subordinates to work at all because they have the protection of their superior.

For long, though, it was difficult to prove which of these two outcomes are most likely to occur. Xu, however, has found a novel approach to do just that. He transcribed thousands of personnel and public finance records of the British Colonial Office during the late nineteenth and early twentieth centuries. He then measured how closely governors in the colonies are connected to the Secretary of State, the official in England who appointed them. He shows that governors connected to the Secretary – as family members, members of the same party, or even as school buddies – enjoy higher salaries through the promotion to higher paid and larger colonies. However, this is only true for the period before the Warren Fisher Reform, a policy that changed the appointment process from patronage to meritocratic.

It is not only that these appointments (before the Reform) earn higher salaries. They also perform worse. Xu finds that a colony’s public revenue performance declines in years when a governor with close ties to the Secretary of State rules. ‘This is consistent’, says Xu, ‘with the interpretation that patronage exerts a negative effect on the performance of socially connected governors. Consistent with the previous result, the fiscal performance gap disappears after the removal of patronage.’ The lesson? Patronage is bad for performance.

A new NBER study sheds some light about why this might be. The three economists use very detailed information, including firm-level balance sheet data, social security data, patent data and detailed data on local elections in Italy (between 1993 and 2014), to show that firms that are more connected to politicians are likely to be less productive. They identify a leadership paradox: ‘When compared to their competitors, market leaders are much more likely to be politically connected, but much less likely to innovate. In addition, political connections relate to a higher rate of survival, as well as growth in employment and revenue, but not in productivity’. It seems to work like this: when a firm has strong political connections, they use these connections, legally or illegally, to get preferential contracts, tariffs or other regulations that allows them to beat the competition. When a firm has few or no political connections, they are forced to innovate to be better than the competition. It is ultimately the more innovative firms that are more productive and dynamic.

Patronage, the evidence shows, is a terrible system. It has also become endemic in the South African state. Without attempts at addressing a patronage system that pervades all levels of government, no Investment Summit will push South Africa’s economic growth to where it needs to be.

*An edited version of this article originally appeared in the 8 November edition of finweek.

The good, bad and ugly of state failure

Even Adam Smith, the father of economics, believed that a strong state is a necessary if not sufficient precondition for a growing economy. As Smith wrote, the state must ‘administer justice, enforce private property rights, and defend the nation against aggression’. But many stop reading Smith there, believing him to be a proponent of limited government. This is not entirely fair. As Jacob Viner already pointed out in 1927, the Wealth of Nations also include references to the state’s obligation to regulate financial markets, educate youth, to protect temporary monopolies on patents, and ‘erecting and maintaining certain public works and public institutions intended to facilitate commerce’. It is therefore just not true, concludes Viner, that Smith was a doctrinaire advocate of laissez-faire.

But what happens when the state does not fulfill its duty? What happens when – despite the intention to do all of these things – the capacity of the state to deliver these services is weak or non-existent?

To some extent, this is exactly what has happened in South Africa. Our education system is a mess. Hundreds-of-thousands of South African kids attend a school each day where the teachers are unskilled, demotivated and often absent, where the facilities are dilapidated and textbooks missing, where school principles battle a limited budget, poor information management, almost no parental support and work in unsafe conditions.

Our public health system, as one June report coined it, ‘teeters on the verge of collapse’. It is estimated that there are 37 000 vacant positions, despite the fact that medical professionals struggle to find employment.

Crime is a major issue our police force cannot seem to bring under control. Prison cells are often filled beyond capacity. We have become used to power outages the last decade, and increasingly we find our taps dry. A lack of government service delivery is one of the major reasons for protests across the country.

What to do? One option is to sit back and wait that the government fixes itself. True, the democratic process allows each of us to vote every five years for a party we hope will represent our interests better. If the incumbent party does not deliver the services we expect to see, we should choose new leadership. But it is a slow and fuzzy process. Humans are not, in contrast to what economists believed for a long time, perfectly rational beings, making decisions that optimise their own self-interest. We are emotional. We trust charismatic politicians, especially the ones that lie often. We are waiting for Godot if we rely only on the political process.

An alternative is to vote with our feet and move to greener pastures. This has happened internally in South Africa already, as thousands of migrants move from the former homelands to the metropoles of Johannesburg, Pretoria and Cape Town. Urbanisation is a phenomenon that will only speed up as the disparity between the urban opportunities and rural doldrum grows.

It’s not only local migration anymore. More and more South Africans, as The Economist alluded to last month, are emigrating. But for most of us without a second passport or a thick wallet, that option is not even on the table.

So, what are our options? One alternative is the market, flaws and all. We see this happening already. Private firms like Curro are quickly filling the void left by the failing school system to service middle and higher income clients. Those who can afford it use excellent private medical facilities offered by the likes of Medi-Clinic, a private firm which has successfully copied its model to countries as diverse as Switzerland and the United Arab Emirates. Many of South Africa’s prisons are privately run. The number of active private security officers in South Africa is nearly double the size of the South African Police Service and South African National Defense Force combined, a R45 billion industry.

The good news is that improved technologies will see more of this happen. For long, the state could be the only provider of most types of infrastructure. This is because such infrastructure (also known as public goods) have two properties that make its private provision difficult: it is non-rival and non-excludable. But better technology makes older forms of infrastructure redundant. Natural monopolies – like electricity generation – has also given way to competition from alternative sources of energy. Now we can each use solar panels on our private homes instead of having to rely on a national source of electricity generation. This allows the private sector to compete in industries that was formerly only the domain of the state.

That is great. It creates opportunities for bright-eyed entrepreneurs to service clients unsatisfied by government services. But it does not, as many fans of the free market would argue, mean that government should simply get out of the way. No, because the market – especially in industries which are prone to the formation of oligopolies and monopolies (in other words, low levels of competition) – can also fail. Here, failure would mean higher prices and poor quality in the name of efficiency. Think of prisons: they are not just places where sentenced individuals’ liberties are removed. They are places where remediation can (should!) occur – but such practices are costly, and unlikely to be encouraged in a private prison that wants to maximise profit.

A thriving economy requires a creative and competitive private sector, one where new technologies can help entrepreneurs to enter industries where the state used to play a dominant role. But government must come to the party too, ensuring, through regulation, a competitive and fair business environment to prevent market failure.

A small but highly competent government is the ideal. South Africa, at the moment, has exactly the opposite.

*An edited version of this article originally appeared in the 28 October edition of finweek.

How to unlock creativity

Let’s say your company wants a new logo. Do you 1) approach the top brand management firm in the city, and ask them to propose a couple of suggestions, 2) get two or three companies to compete in a tournament setting, or 3) launch a national competition to get as wide a selection of entrants as possible? Which one of these options you choose depends on your belief about the creative process.

Ask any management guru about the factors that drive creativity, and they will say something like: Creativity is an extraordinarily complex phenomenon that is almost entirely stimulated by intrinsic motivation instead of extrinsic pressure. They might even argue that high-powered incentives may stifle creativity by crowding out intrinsic motivation. Creatives, these gurus would say, should be left alone, free from competition, to perform their creative acts only motivated by their own artistic commitments. It really wouldn’t matter how many contestants you get; the winner will always be the one that as the most intrinsic motivation. You might as well just go for the best firm (affordable within your budget constraint) from the start.

This is classic social psychology theory, which has gained wide traction in business schools and publications like the Harvard Business Review. It is also not true.

Economists know that competition is the bedrock of a market economy, incentivising those who utilise their resources most efficiently. Those who cannot keep up with their competitors are replaced by them. Yet the belief that creative enterprises – writing literature, performing an opera, designing a logo – should not be subject to the competitive forces of the market, is widespread. Creative people, it is argued, cannot be motivated by big rewards or incentives – if anything, these may only prevent the creative juices from flowing. Competitions that aim to stimulate creativity in the workspace, for example, might actually have the opposite effect of crowding out the most creative people by those only interested in the financial rewards.

The reason for the persistence of this belief is that is it has been almost impossible to test. For one, how does one measure creativity? We can often measure the inputs to the creative process (R&D spending) or its outputs (patents, for example), but we know very little about what happens in-between.

In a new NBER Working Paper, Daniel Gross of Harvard Business School offers one possibility. He makes use of online logo design competitions to test whether competition leads to more original designs. It works like this: Firms would solicit custom designs from freelance designers who compete for a winner-take-all-prize. The prizes are typically a few hundred dollars and attract on average 35 players and 100 designs. One feature of the competition is that the firms can provide real-time feedback to the designers in the form of a one to five-star rating. Designers not only get feedback on their own work but can also see the designs and feedback on the other contestants.

Gross then uses image comparison algorisms (also used by Google Image Search software) to calculate similarity scores between pairs of images in a contest. This he uses to quantify the originality of each design relative to prior submissions by the same player and their competitors.

The firms’ ratings of the logo designs are critical to the success of the competition. Gross directly estimates a designer’s probability of winning, and show that the ratings are meaningful: ‘the highest-rated design in a contest may not always win, but a five-star design increases a player’s win probability as much as 10 four-star designs, 100 three-star designs, and nearly 2,000 one-star designs’.

And because each designer can submit their logo multiple times, Gross is able to test the effect of more or less competition on the originality of the logos. He finds that competition has large effects on the content of designers’ submissions. ‘Absent competition, positive feedback causes players (designers) to cut back sharply on originality: players with the top rating produce designs more than twice as similar to their previous entries than those with only low ratings. The effect is strongest when a player receives her first five-star rating – her next design will be a near replica of the highly-rated design – and attenuates at each rung down the ratings ladder. However, these effects are reversed by half or more when high-quality competition is present: competitive pressure counteracts this positive feedback, inducing players to produce more original designs.’

In other words, when two designers compete, and both receive five stars, they are far more likely to come up with a more creative and original design in the second round, than if they were the only one to receive a five-star rating. Competition induces creativity.

But – too much competition can also be bad. Gross finds that heavy competition discourages further investment. ‘Empirically, high performers’ tendency to produce original work is greatest when facing roughly 50-50 odds of winning – in other words, when neck-and-neck against one similar-quality competitor.’ If the firm thus gives too many five-star ratings, creativity will be limited as many designers will simply exit the competition.

There is thus a delicate ‘Goldilocks’-level of competition: too little competition, and there is no creativity; too much, and creativity is stifled by designers (and often the good ones) simply exiting the game.

The foremost lesson of these results, says Gross, is that competition can motivate creativity in professional settings, provided it is balanced. ‘In designing contracts for creative workers, managers ought thus consider incentives for high-quality work relative to that of peers or colleagues, in addition to the more traditional strategy of establishing a work environment with intrinsic motivators such as freedom, flexibility, and challenge. Note that the reward need not be pecuniary: the same intuition applies when workers value recognition or status.’

And the applications are pervasive: Need an engagement ring to stand out from the crowd? Need a dramatic music score for your advert? Need a new plan for those unfinished bridges in Cape Town? Need a new logo? If we believe Gross, then option 2 – using two or three companies to compete in a tournament setting – seems like the best bet if you want the most creative solution.

*An edited version of this article originally appeared in the 11 October edition of finweek.

An ode to optimism

When I began my postgraduate studies – in 2004 as an Honours in Economics – I had to choose a supervisor for my mini-dissertation. I wanted to work on infrastructure investments, and approached prof Stef Coetzee, then affiliated to the Stellenbosch Business School, because of his expertise in development economics and his proximity to the world of business. He agreed – and I eventually produced a mini-dissertation twice the length of what it should have been.

Prof Coetzee was a wonderful guide for a naive but enthusiastic student. He certainly had the academic expertise to dismiss most of my ideas; he had completed a Masters degree at Stellenbosch University’s Economics department in 1973, the department where I now work, and a PhD at the University of the Free State in 1980. In the above picture, taken on 2 February 2018, Coetzee (on the left) appears with three former Stellenbosch classmates, prof Eon Smit, Hannes le Roux and prof Philip Mohr, men who have all had a profound impact on the South African academic landscape.

Yet prof Coetzee were never dismissive of my attempts to think boldly about the infrastructure that was required to put South Africa on a higher growth trajectory. Perhaps that is because he had experience of leading big teams and organisations, and thinking outside the box. He was a former rector of the University of the Free State, director of the Centre for Policy Analysis at the Development Bank of Southern Africa, and would later be CEO of the Afrikaanse Handelsinstituut.

But I’d like to think that it was also his personality to be open to new ideas, and optimistic about putting them into practice. Because of social media like Facebook, we could reconnect the last few years. Even when things were going badly with the economy, he would be optimistic that things would turn around.

He expressed these views in a chapter he wrote for a book I edited on what students should know when they go to university. Written a decade ago, but still relevant today, here is a short summary:

What do the above challenges and opportunities mean for us as South Africans? Probably the most important is that it leaves the younger generation with a future full of opportunities! The opportunities may be different from in the past, but it will definitely be exciting. The general expectation is that the economic growth of developing economies will in the near future be higher than that of developing economies and will also provide bigger investment opportunities.

Secondly it is also clear that exceptional leadership will be required in order to position South Africa as one of the foremost developing economies. Insight on South Africa within the world and the African context will be necessary to develop the correct policies and strategies.

Thirdly it appears that the opportunities will stretch across a wide spectrum and be multi-dimensional and multi-disciplinary. We are going to need scientists, academics, teachers, business people, farmers, doctors, nurses, and engineers to make South Africa a competitive country, but also one that can handle some the most important problems.

Fourthly new skills will be required in a fast-changing world: better flexibility, the ability to work in multi-cultural contexts, better language skills, excellent technological skills, innovation, creativity and the ability to work in teams on different continents, to name but a few.

Fifthly the future will place bigger demands on young people to achieve breakthroughs on political, economical, social, technological and environmental level. It will simultaneously provide exciting opportunities.

Prof Coetzee passed away on Saturday. Despite attempts to do so last year, we never had the chance to meet up again in person. His last few messages to me were, as always, optimistic, despite his illness and setbacks. He was optimistic about the South African economy, about my career, about the Springboks.

Now that I have my own students to supervise, I have a deeper appreciation of the role that supervisors can play in students’ lives. This, then, is a belated thank you to prof Stef Coetzee, my first supervisor who, unbeknownst to both of us, steered my own academic journey into a more optimistic future.

Why are there so many single mothers?

Here is a statistic to get your head around: Of the 989 318 babies born last year in South Africa, 61.7% have no information about their father included on their birth certificate. We don’t precisely know why the women who register these babies do not record the father’s information, but it is highly likely that it is because the father would not want to be involved in the raising of the child. They are, in fact, single mothers. This conjecture seems to be supported by other evidence: the HSRC estimates that 60% of South African children have an absent father, and that 40% of mothers are single parents.

Explaining why these mothers are single is not easy. One argument is historical. Throughout the late nineteenth and twentieth centuries, young men would move to the mines, away from structured family life in the countryside. This migrant labour system, it is said, would explain the large number of single women. While plausible theoretically, this explanation neglects a key empirical reality: that the share of single mothers is on the increase. The migrant labour system, owing to the apartheid-era homeland system, was arguably most intense during the twentieth century. And yet this is also the period where the share of single mothers was much lower. The number of migrant workers fell after the dismantling of apartheid settlement policies and, since the 1990s, the decline of the mining industry. Yet it is exactly then that we see a significant rise in the share of single mothers.

If the migrant labour cannot explain the large numbers of single mothers, what else could? Dorrit Posel and Stephanie Rudwick, in a paper published in 2014 by the African Studies Association, show that the Zulu, in particular, have very low marriage rates, as low as 30%. Perhaps, you might argue, it is just that women prefer to be single – that an unmarried life is better than a married one. Well, the evidence does not support this theory. Using survey data, Posel and Rudwick find that this is not a preference: more than 80% of unmarried Zulu women report that they would like to get married (as do the men, incidentally). The reason they attribute to women remaining unmarried despite their wish to be married is lobola, or bride wealth: ‘Our qualitative data demonstrate that frequently the way ilobolo is practiced, and particularly the amount that is requested relative to men’s opportunities in the South African labour market, can contribute to delayed marriage and nonmarriage.’

Both the migrant labour and lobola systems are unique to southern Africa. But the share of single mothers has been rising almost everywhere. In fact, 62% of all births to non-college educated mothers in the United States in 2014 were to unmarried women, very similar to the South African figure. Something more universal seems to be behind these trends.

One possibility is that men’s poor economic conditions contribute to them delaying or eschewing marriage. This is the argument Posel and Rudwick put forward, but one that is also found for the United States, where non-college educated men’s relative incomes have declined over the last three years. A new paper, soon to be published in the Review of Economics and Statistics, tests whether it is, in fact, men’s poverty that prevents them from marrying. The two authors, Melissa Kearney and Riley Wilson, link the fracking of shale gas in the 2000s to marriage rates. The idea is that, if the hypothesis is true that men do not marry because of poor economic conditions, then a fracking boom, which would create more employment and lead to higher incomes, should result in larger numbers of men being willing and able to marry. Kearney and Wilson use a sophisticated statistical analysis to show that 1) there is no impact on higher incomes of non-college educated men on the likelihood of getting married, 2) there is a boost to fertility rates after their income improves, but this increase is similar for both married and unmarried men. They conclude: ‘We find no evidence from the fracking context to support the proposition that as the economic prospects of less educated men improve, couples are more likely to marry before having children.’ In short: it’s not poverty that prevents marriage.

So what is it then? One possibility is that it might be higher female incomes. Not only have women entered the labour market at historic levels since the 1960s, but social transfers to support children has also increased. Both sources of income would give women more agency (or bargaining power) within the household, and reduce the need to live with an income earning partner. While much evidence shows that giving women more household resources improves the outcomes for children, it may have the unintended consequences of absolving men from their child-rearing responsibilities. Thomas Sowell, a US libertarian economist, notes that in 1960, almost a hundred years after the end of slavery in the US, 22% of African Americans grew up in households with only one parent. ‘Thirty years later, after the liberal welfare state, that number had more than tripled. We can speculate as to how much of that 22% was due to slavery, but we know that that tripling was not due to the legacy of slavery. It was due to the legacy of a whole different set of policies.’

But it is also not that easy. The rise in single mothers, although it has increased in the last two decades, began before the child support grant was introduced in South Africa. Pensions may play a role, but it is unclear to what extent they alone can explain the rise in single motherhood.

Family structure is rapidly changing. More children are now growing up with one rather than two parents. Even if the causes remain fuzzy, one thing is certain: the consequences are likely to be profound.

*An edited version of this article originally appeared in the 26 September edition of finweek.

A radical solution to land ownership

What if I could offer you the following three outcomes – 1) an increase in government revenue to the extent that a Basic Income Grant (BIG) can be afforded, 2) a substantial decline in wealth inequality, and 3) a sustainable solution to the land crisis – with just one policy intervention? Fantastic, you’d say, but naïve and, frankly, absurd. There is no policy that we know of that can tackle these immense societal challenges, all in one go.

Wait, I’m not done yet, I’d answer. This policy would make it much easier to build infrastructure, get rid of derelict buildings, would ramp up GDP per capita significantly, and would foster social cohesion.

Seriously? Don’t be ridiculous, you’re dreaming, you’d respond. And to do this, I’d continue, we’d need to do two things that seem almost directly opposed to one another. We need to expand markets. You might nod in agreement, something sensible for the first time. Oh, and we must abolish private property altogether.

This, in short, is the recommendation by two economists, Erik Posner and Glen Weyl, in their new book Radical Markets. Critics seem to agree that this is something worth discussing; Kenneth Rogoff calls this ‘perhaps the most ambitious attempt to rethink democracy and markets since Milton Friedman’.

Although their ideas have huge implications for democracy and immigration too, I will focus here on their first chapter, and probably the one most relevant to South Africa currently: property. They propose a Common Ownership Self-Assessed Tax (COST) on wealth. Property, they argue (like many economists before them), are inevitably monopolistic, and monopolies create inefficiencies in the market. Their COST aims to remove these allocative and investment inefficiencies by introducing a live auction for every asset in society.

So, how does it work? Let’s take Khulekani. His young family has just expanded, and so he wants to buy a new house. He would go to a website – let’s call it UmhlabaWethu.co.za – and open a sort-of Google Maps that will allow him to see every property in South Africa, valued by the owner of the property. He can then decide to buy any property, by just clicking on the property, at the price the owner has listed. The ‘right to exclude’, one of the central tenets of private ownership, is therefore waived in this new system. Every property owned by a company or individual (or government!) must be valued and listed.

So, what prevents owners from just making excessively high valuations, making Khulekani’s attempt at buying a house impossible? Tax. In this system, each owner will pay an annual tax on the self-assessed value of their property, thereby waiving the ‘right to use’, the second central tenet of private ownership. The authors explain: ‘In the popular image of private property, all benefits from use accrue to the owner. Under a COST, on the other hand, a fraction of this use value is revealed and transferred to the public through the tax; the higher the tax, the greater the fraction of use value transferred.’

In other words, all property in South Africa would be on a permanent auction, where the current user of the property determines the price (but pay for that price in tax). It’s almost like Uber, for property.

Imagine a private investor wants to build a high-speed monorail in Cape Town. To do this at present would be almost impossible, as owners of properties on the intended route would hold out for a high price, knowing that they have monopoly bargaining power. A COST would allow an investor to go online and buy up all the properties at the listed price, combine them, and start building the monorail. (Of course, they must also value that property, and pay tax. If another investor believes they can build a more profitable monorail, they might just buy-out the original investor’s right of use.)

Or imagine that the property tax is returned to citizens as a Basic Income Grant. By the authors’ rough calculations, every US citizen from a similar system could receive $20000 annually, which for most would be far less than they would be paying in tax. By their estimates, it would only be the richest 1% property owners that would be paying more than they receive – and often a lot more. This not only reduces inequality (by 4 Gini points, according to their estimates), but it also acts as a subsidy for the poorest.

In South Africa, COST tied to a BIG could do far more to alleviate poverty and address inequality than a policy like expropriation. Unproductive land would be a direct cost to all society: higher property values paying more tax mean that more can be redistributed to everyone. As the authors note, ‘a world in which everyone benefits from the prosperity of others would likely foster higher social trust, a factor essential to the smooth operation of the market economy’.

‘The sharing of wealth would be in accord with many commonsense notions of justice. Wealth is rarely created solely by the actions of the people who are paid for it under capitalism. They normally benefit from the help of friends, colleagues, neighbours, teachers, and many other people who are not fully compensated for their contributions. A COST would better proportion the distribution of wealth o the labour that created it.’

This is a radical proposal. It might have unintended consequences that we cannot currently imagine. That’s why the authors propose a piecemeal adoption of these policies. That is a sensible approach. Experimentation will be needed, perhaps even within one municipality first.

But the radical economic transformation that COST can accomplish is a lesson in how creative thinking – and perhaps a willingness to put away our ideological differences – can help find solutions to a problem that we had thought to be insurmountable.

*An edited version of this article originally appeared in the 13 September edition of finweek.

Don’t bet against the historians

Every three years, economic historians from across the globe gather in one place to discuss the latest research in our field. And so it was again this year that, in early August, more than 1400 of these interdisciplinary scholars convened at MIT in Boston for the latest rendition of the World Economic History Congress (WEHC). It was hot and humid outside, but inside the conference and classrooms, the discussions were no less heated.

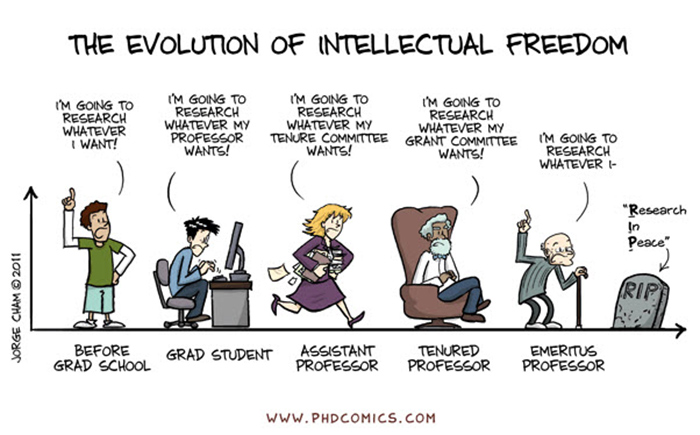

Normally a friendly and somewhat reserved crowd, it is as if the political developments of the last three years has forced economic historians out of their slumber. That classic history cartoon – an old man sitting in his rocking chair saying ‘Those who don’t study history are doomed to repeat it. Yet those who do study history are doomed to stand by helplessly while everyone else repeats it’ – seems more apt than ever. As always, there were papers on esoteric topics such as occupational mobility in early-twentieth century Greenland, wine glasses in China during the eighteenth century, or what pollen data can tell us about market integration in Ancient Greece. But it seemed to me, now at my fourth WEHC, that this year the research questions were more aimed at the big questions of the present: How does globalisation lead to populist pushback? Why are inequalities increasing in rich countries, and what can be done about it? How do entrepreneurs use (abuse) networks to become successful? History offers clues (but no quick-fix answers) to all these questions.

Two plenary sessions exemplified this. On the last day of the conference, Jane Humphries and Claudia Goldin debated the missing role of women in economic history. While Humphries, professor of Economic History at Oxford University, discussed the importance of women to the Industrial Revolution, Goldin, a professor of Economics at Harvard, discussed the more recent transition of women into the labour market. She showed, by using extensive data from Harvard Business School graduates, how the gender wage gap can to a large extent be explained by women’s preferences for flexible work. This, she argued, what can be done to close the gap further: women prospered in teams where their skills are substitutable. Instead of operating as a single physician, for example, female doctors were much more likely to stay in the labour market and work more hours if they worked as part of a team of medical experts.

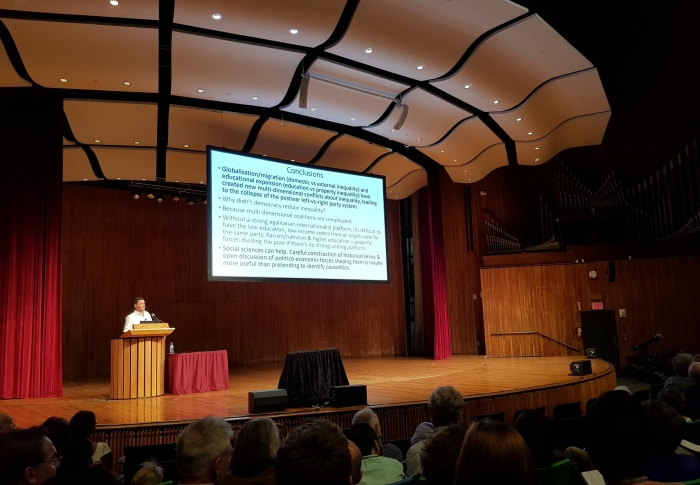

But the big event of the congress was undoubtedly Thomas Piketty’s plenary session. Piketty, who is professor of Economics at the Parish School and known for his best-seller Capital in the 21st Century, has now shifted his inequality work to the political realm. He made a compelling case that the expansion of higher education has altered the traditional alliances in politics. Using three case studies – of France, England and the US – he showed that support from the intellectual elite – those with university degrees – has increasingly shifted to the left in all three countries over the last three centuries. For example, in 1948, less than 20% of all voters with a Masters degree voted for the US democratic candidate; in 2016, it was 70%. Why? Remember that the Democratic Party in the US (or the Labour Party in the UK) is more in favour of redistribution than the Republican Party (or the Conservative Party). For that reason, they tend to get most of their support from the poor (or, at least, those that stand to benefit from redistribution). But the poor is not uneducated anymore. In 1948, slightly more than 20% of voters had a tertiary degree, while in 2016, it was more than 50%. By definition, of course, if 50% of voters have a university degree, they cannot all be in the richest 10%. This means that there has become a disconnect between the educated and the rich. That is why, according to Piketty, new political positions become possible; he identifies four groups of almost equal size that have now emerged in his native France: internationalist-egalitarian (pro-migrant, pro-poor), internationalist-inegalitarian (pro-migrant, pro-rich), nativist-inegalitarian (anti-migrant, pro-rich), and nativist-egalitarian (anti-migrant, pro-poor). The success of Emmanuel Macron was that he could appeal to multiple of these groups.

‘Politics has never been a simple poor vs rich conflict’, says Piketty. ‘One needs to look at the multi-dimensional content of political cleavages.’ We also see this play out in the South African context. The ANC is currently a broad church – from the rural poor to the urban sophisticate. But how long can they maintain this delicate balance, when issues such as globalisation, migration and automation will have decidedly negative effects on one part of their electorate while benefiting another? And these clashes may not be along the fault lines of yesteryear. Capital and labour, poor and rich, educated and uneducated are now in flux. As Piketty says, the US might be returning to the 19th century political alignment, with globalists (high-income, high-education) on one side and nativists (low-income, low-education) on the other. Or it could go the route of the Democratic Party in the US, whose pro-slavery/segregationists introduced poor white policies which also benefited poor blacks. Or we could instead see the re-emergence of a globalist-egalitarian elite like we did in the aftermath of World War II, a system that resulted in the end of colonialism and a global Golden Age of growth.

The high levels of inequality in South Africa would make the continuation of a single, unified ANC seem unlikely in the medium to long run. Rapid globalisation, automation and increasing pressure on immigration are fissures that even a great leader will be unlikely to control. If history (and economic historians) have anything to add, it is that the future is unlikely to be just a continuation of the present.

**An edited version of this article originally appeared in the 30 August edition of finweek.

The cost of crime

It is almost something that defines South Africans: having lived through the traumatic experience of a violent crime or, at the very least, know someone that have. 19016 murders were committed in the country in 2016/2017, according to the South African Police Service, or 34.1 murders for every 100 000 people. (Contrast Afghanistan at less than 7 murders per 100 000 people, Argentina at less than 6, Kenya at less than 5, India at less than 4, Iran at less than 3, and Ghana at less than 2.) Almost the same number of attempted murders as murders were reported to the police. On average, 109 men and women were raped each day. In 2016/17, there were 22,343 incidents of house robbery recorded, or 61.2 each day.

These statistics are nothing less than shocking. They explain why most South Africans list crime as their number one concern, far above access to land or inequality, and why those that decide to emigrate list ‘improved safety and security’ as the top reason for leaving. Given the widespread concern, one would expect that safety and security would be a top research priority at South African universities. It is not. A 2017 World Bank study by leading social scientists reports: ‘There is a dearth of research on crime in South Africa, which is particularly problematic in this country given the extraordinary high crime rates reported here.’ The study begins to fill the gap, but the results show why understanding the causes of criminal behaviour is so difficult.

Surely poverty is the most obvious explanation for crime? Well, consider that the province with the second highest murder rate in the country is the Western Cape (with 51 murders per 100 000 people), and the province with the lowest murder rate is Limpopo (with 14 murders per 100 000 people). The Western Cape is, of course, much more affluent than Limpopo. This suggests that poverty is not the main reason for crime. Perhaps, then, inequality is what matters. The authors of the World Bank study answer this emphatically. Using a sophisticated regression analysis, they conclude that ‘we did not detect any relationship between inequality and violent crime, nor between unemployment and any crime type.’ If it is not poverty and inequality, then what?

We know, for example, that the victims of most violent crime often know the perpetrator. The 2016 Demographic and Health Survey reveals that 17% of women aged 18 to 24 had experienced violence from a partner in the 12 months before the survey. Economists in the US have developed sophisticated household bargaining models to explain this form of violence, but more could be done to test these models in the South African context.

If there is a dearth of research on the causes of crime, there is even less known about the consequences. The costs of a traumatic experience can be multifaceted for the victim, from the direct medical costs to the life-long psychological and emotional pain. And the effects on family and friends, their relationships and interactions, their productivity and future plans, are enormously difficult to quantify.

A new NBER working paper attempts to measure one, often forgotten, cost of domestic violence: the effect on children in utero. Because crime statistics is difficult to get past university ethics committees, it is difficult to track the victims of crime over time in order to measure the effect of the traumatic experience on later-life outcomes. The three authors of this study, Janet Currie, Michael Mueller-Smith and Maya Rossin-Slater, use a unique source of linked administrative data from New York City. They combine birth records with information on maternal residential addresses with the exact locations and dates of reported crimes to compare the outcomes of women who have a reported assault in their home in months 0 through 9 postconception to those who experience an assault 1 to 10 months after the estimated due date.

Their results are startling. Women who suffer from domestic violence during pregnancy, especially during the third trimester, have as much as 50% higher rates of births that are very low birth weight (less than 1,500 grams) and are very pre-term (less than 34 weeks gestation). The likelihood of induced labour also increases for these women.

The authors then do a back-of-the-envelope calculation of the costs of US domestic violence. ‘We calculate an average social cost of $41,771 per assault during pregnancy. Assuming that 2.6 percent of pregnant women experience an assault—the national victimization rate estimated from survey data—this figure translates into a total annual social cost in excess of $4.25 billion.’

Many might groan at trying to put a number on these tragic experiences, but quantifying the social costs – in other words, the costs for society – of domestic violence is one way to help governments prioritise preventative and remedial expenditures. The high rates of domestic violence and abuse in South Africa, particularly of women during their most fertile years, suggests that the costs of domestic violence would be significantly higher here compared to the US. And because domestic violence is more likely to be suffered by women from poor households, this may suggest, according to the authors, ‘an important and previously understudied mechanism by which early-life health disparities perpetuate persistent economic inequality across generations’.

Violence, in all its manifestations, is costly for society, which is why we should invest more resources into understanding its causes and consequences. Domestic abuse, in particular, seems to carry not only a cost for the current generation, but is likely to affect the next generation through its intergenerational effect on children in utero. Understanding and preventing it may be one of the key ways to fight deepening inequality and poverty persistence.

**An edited version of this article originally appeared in the 16 August edition of finweek.

The big misconception about the free market

There are many who view the free market with skepticism. Some are downright hostile towards it, proclaiming – erroneously so, given the empirical evidence of history – that capitalism hurts labour, the environment, or the poor, and is largely to blame for the evils of this world. Others grudgingly accept that capitalism is a better system than the alternatives, but look down, much like the nobility viewed merchants in Medieval times, on those in the business world as scammers and frauds. After the Steinhoff collapse, many commentators, often those schooled in the humanities, pointed to unethical behaviour of the ‘markets’ or the ‘business community’ or the ‘corporate sector’. In its crudest form, they blamed it all on ‘free market capitalism’ or, that insult of insults, ‘neoliberalism’.

But that interpretation is predicated on a fundamental misunderstanding of what ‘the free market’ actually is. A student pointed me recently to a ten-part television series by one of the leading economists of the twentieth century, Milton Friedman. Recorded in the 1980s but as relevant today as then, Free to Choose spells out Friedman’s belief that the ‘free market’ is preferable to the alternative of government intervention. The series is now freely available on YouTube.

After each episode, Friedman debates with invited guests, many who don’t share his views, about the pros and cons of the market. The moderator at some stage points out that both Friedman’s opponents, one from big business and the other from government, tends to agree that government intervention – say, to increase tariffs – is a good idea. How would he explain this? Friedman responds that it is perfectly rational that the two agree, even if for opposite reasons. ‘The two greatest enemies of free enterprise and freedom in the world, have been on the one hand the industrialists and on the other hand most of my academic colleagues who end up in government, and for opposite reasons.’ His academic colleagues, Friedman argues, want freedom for themselves. ‘They want free speech, they want freedom to write, they want freedom to publish, to do research. But they don’t want freedom for any of those awful businessmen.’

‘The businessmen are very different’, says Friedman. ‘Every businessman wants freedom for somebody else. But he wants special privileges for himself. He wants a tariff from congress.’

Entrepreneurs are in the business of making money. One way to do that is to produce a good or service that is better than the competition through efficiencies or strategy or innovation. So far, so good. Another way to do this is to eliminate the competition altogether. This can be done by getting government to impose a tariff on imports, or to get government to issue special licenses, or to convince government to issue regulation that protect your business from superior competition.

South Africa, of course, has a long history of this type of government intervention. The VOC that set up a refreshment station at the Cape was a company founded on monopoly trading rights. Paul Kruger’s ZAR government was built on a complex network of monopoly licenses with industrialists, and so, too, was the apartheid state. The scale of collusion between government and big business in more recent years ultimately coined a new term: state capture.

This is not free market capitalism. Put differently, it is not the type of capitalism that creates prosperity. Friedman made the same point in the 1980s: ‘It’s not proper to put the issue as industrialists versus government. On the contrary, one of the reasons why I’m in favour of less government, is because if you have more government, industrialists take it over. The two together form a coalition against the ordinary worker and the ordinary consumer. I think business is a wonderful institution, provided it must face competition in the marketplace, and it can’t get away with something except by producing a better product at a lower cost.’

Think of South Africa’s most concentrated sectors – telecommunications, electricity, healthcare, air travel. In each case, the government is either a significant player themselves, or they impose tight regulation. Much of this regulation is founded on good intentions, of course. Licenses often require a minimum safety standard; one wouldn’t want just anyone opening a hospital or flying an airplane. But most often, it is these well-intentioned regulations that strangle competition, creating oligopolistic sectors that favour a few big businesses.

South Africa’s Competition Commission is tasked with investigating and mitigating collusive business practices and other ways firms may abuse their market position. When a large firm acquires another, they need to file an application to the commission for approval. This prevents that one firm dominates a market, pushing up prices and hurting consumers.

But the Competition Commission can only do so much. In many cases brought before it, the South African government is an active player in the market – think SAA – or regulates the industry through other bodies – like the telecom spectrum ICASA controls. We cannot just rely on the Commission to ensure free competition: it requires a widespread acceptance in government that any regulation that impedes competition hurts both workers and consumers. The Minister of Energy signing the power purchase agreements for 27 mostly solar and wind projects – and thus encouraging competition in the market for energy generation – is an excellent step in the right direction. Our failing education or health systems are not so lucky; both suffer as a result of too little competition.

The big misconception about the free market is that ‘the market’ is often equated with ‘big business’. As Friedman notes, they are not the same thing. There is good reason for oligopolistic firms to cozy up to government: it is a great way to get rid of competitors. But over the last decade, South Africans have learnt the painful consequences of what happens when that system becomes entrenched. In contrast, a society that prioritises market competition is most likely to benefit the ordinary worker and the ordinary consumer. This is because competition fosters innovation. And innovation improves productivity, growth and living standards. That is, ultimately, the long road to economic freedom.

**An edited version of this article originally appeared in the 2 August edition of finweek.

Making South Africans more productive

Economic growth is defined, in its most basic form, as doing more with less. Economists often overcomplicate things. We talk about ‘an increase in gross domestic product (GDP) per capita of 2%’ when in fact we could simply say ‘the average South African produced 2% more than last year’. More production translates into greater incomes. Take India and China. At an average growth rate of 7%, these countries will double their production/output/income in 10 years. In contrast, if South Africa continues to grow at 2% it will take 36 years to double our income. That is why South Africans are so upset: we see millions of Indians and Chinese growing wealthier, transforming their countries from subsistence breadbaskets to industrial and ICT powerhouses, while we are frustrated by the meagre increases in our living standards.

The Indians and Chinese also show that it is only economic growth that will allow us to escape poverty. We cannot redistribute ourselves rich. Even if incomes were equalised in South Africa, we would still be poorer than those Americans who live below the poverty line. The unescapable truth is that if we want to prosper, we need to make South Africans, all of us, more productive; we need to get South Africans to produce more than they do at the moment.

With an unemployment rate upwards of 30%, this would not seem to be too difficult a task. A lot of people are able and willing to work – to produce stuff – but they currently cannot find employment at the price they are willing to work for. How we address this mismatch is a question that should occupy the minds of the smartest people in our society. Perhaps we need more students to study growth theory, industrial organisation, labour economics and economic history – compared to India and China, for example, too few South Africans take up graduate studies in Economics. But perhaps we also need more scientists, entrepreneurs, tinkerers, coders, designers, educators and experimenters with the vision and ability to make their fellow citizens more productive. In short: we need more people like Norman Borlaug.

An agronomist who completed his PhD in plant pathology, Borlaug became fascinated as a student with the productivity of crop farming. In the 1940s, he moved to a research unit in Mexico where he began developing high-yield, disease-resistant wheat varieties. His wheat varieties, combined with modern agricultural production techniques, soon improved Mexican farmers’ incomes, and then spread to other countries. By 1963, Mexico became a net exporter of wheat. Between 1965 and 1970, wheat yields nearly doubled in Pakistan and India. In 1970, Borlaug was awarded the Nobel Peace Prize for leading the ‘Green Revolution’, a massive transformation of agricultural productivity in mostly Latin America and Asia.

A new NBER Working Paper by three economists spell out just how consequential this revolution was. They use variation in geography combined with the exogenous timing of agricultural research successes in high-yielding crops to measure the effect of the high-yielding crops on output. The results are startling: they find that a 10-percentage point increase in the share of area under high-yielding varieties in 2000 is associated with a massive 10-15 percentage point increase in per capita GDP. To put that differently, if a country moves from having no high-yielding crops to having half its crops of the high-yielding type, then income will almost double. That is why Borlaug is considered to have saved almost a billion people from starvation.

Higher agricultural output, in a Malthusian world, usually results in fertility increases as food becomes more abundant. But the authors also show that this was not the case with the Green Revolution. Higher agricultural yields actually reduced population size, as parents chose quality over quantity.

The paper also shows that the new high-yielding crop varieties, in contrast to what many environmentalists believe, actually benefited the environment. Increases in the area under high-yielding varieties has, the authors find, tended to reduce the amount of land devoted to agriculture – ‘improvements in the productivity of food crops actually lead to intensification of agriculture on a smaller land area, preventing expansion on the extensive margin’.

Their results suggest at least three lessons. First, there is huge potential for improving living standards in developing countries through new crop varieties remains. This is especially true in many African countries, where adoption is far from universal, and agriculture is still an important sector. Second, new biological technologies are available to increase productivity of some crops, both by increasing yields and by reducing costs – for example, disease-resistant varieties that minimise the need for spraying with costly pesticides. Third, ‘technology continues to have a huge potential for improving incomes in the poorest places on our planet’. Indeed, the authors’ results suggest that the investments in the development of high-yielding crops have been ‘the most successful form of foreign aid to developing countries in the past half century’.

By itself, land reform in South Africa will not be enough to improve living standards, as the rest of the continent’s poor agricultural productivity attest to. What is needed is large investments in developing new technologies – universities, research institutes and the research capacity of state-owned enterprises, with the help of foreign donors like the Bill and Melinda Gates Foundation – to improve the productivity of our farms and factories and fibre-optic networks.

‘Whoever makes two blades of grass to grow upon a spot of ground where only one grew before,’ writes Jonathan Swift in Gulliver’s Travels, ‘would deserve better of mankind, and do more essential service to his country, than the whole race of politicians put together.’

Technology and scientific advancement is often last in line when the menu of economic policies are discussed in South Africa and on the rest of the continent. But technology that can ‘make two blades of grass to grow upon a spot of ground where only one grew before’ – or, in a more general sense, can make South Africans produce more with less – is the only way we can escape the stasis of the last decade, regardless of what South African politicians repeatedly promise.

**An edited version of this article originally appeared in the 19 July edition of finweek.

Why vegetarians are from Knysna and meat-eaters from the Karoo

Talking about factor endowments sounds like one of the most boring dinner conversation topics ever. The land/labour ratio of India, Europe or Africa does little to whet the appetite, and might actually be a polite way to signal that the evening is coming to an end. And yet, factor endowments explain far more about ourselves – from what we produce and trade, to how we marry and what we eat – than we would care to admit.

The ratio between a country’s endowment of land and labour – the land/labour ratio – is common to economic theory. One of the central theories of international trade, for example – the Heckscher Ohlin theory – uses factor endowments to explain what countries produce and trade. In its most succinct form, it says that a country will export goods that use its abundant factors intensively, and import goods that use its scarce factors intensively. Basically, if South Africa has a lot of land relative to Bangladesh, then we should produce things that use land intensively (like cattle), and export this to Bangladesh, while Bangladesh should produce things that uses its most abundant factor – in this case labour – most intensively (like clothes), and export this to South Africa. Both countries would win from the trade. This is standard Econ 101 stuff.

But increasingly the land/labour ratio is used to not only explain a country’s comparative advantage in production, but also explain the social and cultural differences between places. How we marry is one example. Take the lobola, the bride price that is traditional to most marriages in southern and eastern Africa. Why do Africans have a lobola, while Indians have a dowry? One answer: factor endowments. See, Sub-Saharan Africa traditionally had a lot of land relative to people. A high land-to-labour ratio meant that people were immensely valued for their ability to perform labour. Women, given their reproductive ability, was therefore of great value, and powerful men would claim multiple wives to ensure not only a long lineage but also a large workforce. That is also why polygamy is still popular amongst many African societies across the continent, and why indigenous slavery (raids on neighbouring tribes to poach their people rather than their land) was a feature of precolonial Africa.

By contrast, labour is abundant in India relative to land. There the institution of bride price never emerged; instead, it would be a dowry system, where the bride or bride’s family would pay (in property or money) for the right to marry the husband. This was to consolidate the most important asset – land, not labour – to ensure a successful lineage. Europeans, incidentally, had the same low land-to-labour ratio, which is why it is typically the wife’s family who pays for the wedding in European custom.

Factor endowments, surprisingly, can also say much about what we eat. In a series of tweets on 12 June, Sarah Taber, agricultural scientist and host of the Farm to Taber podcast, explained just how our eating habits are the result of the environment and endowments (the land/water ratio) around us. She starts by mentioning that many cultures have traditionally had low or no-meat diets. Think of the Ganges valley, the Nile valley, or the Amazon. What do these places have in common? It rains a lot. This matters because in such environments, plants that humans can consume tend to grow, like those with tender stems, leaves and fruit, or those with enlarged seeds or energy storing roots. The rest of the plant is basically useless to us.

On the other hand, many societies, like the Mongols, the Bedouin, the Inuit or the Masai, have evolved to consume almost only meat. This is because they live in places that are dry or very cold, where plants are either very sparse or very tough, and made entirely of things that humans cannot digest. These plants are almost entirely cellulose, having tough stalks, fibrous leaves, and so on. But cows, sheep, goats, horses and camels can consume these scrubs with 3- to 4-chambered stomachs that turn the cellulose into sugars.